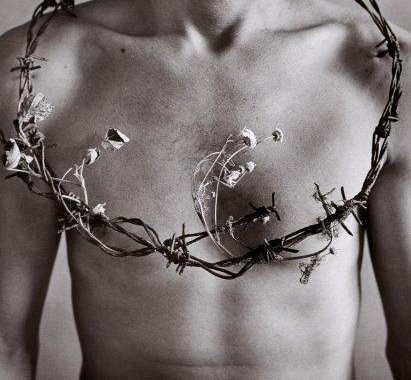

“One watches them on the seashore, all the people, and there is something pathetic, almost wistful in them, as if they wished their lives did not add up to this scaly nullity of possession, but as if they could not escape. It is a dragon that has devoured us all: these obscene, scaly houses, this insatiable struggle and desire to possess, to possess always and in spite of everything, this need to be an owner, lest one be owned. It is too hideous and nauseating. Owners and owned, they are like the two sides of a ghastly disease. One feels a sort of madness come over one, as if the world had become hell. But it is only superimposed: it is only a temporary disease. It can be cleaned away”.

“One watches them on the seashore, all the people, and there is something pathetic, almost wistful in them, as if they wished their lives did not add up to this scaly nullity of possession, but as if they could not escape. It is a dragon that has devoured us all: these obscene, scaly houses, this insatiable struggle and desire to possess, to possess always and in spite of everything, this need to be an owner, lest one be owned. It is too hideous and nauseating. Owners and owned, they are like the two sides of a ghastly disease. One feels a sort of madness come over one, as if the world had become hell. But it is only superimposed: it is only a temporary disease. It can be cleaned away”.D. H. Lawrence (1885 – 1930)

A small voice awoke me from a deep trance only to realize that I have not recorded my thoughts for far too long. At the point where you are convinced that it is impossible to travel more than what you are, you allow the world to crank it up another notch. The opportunities to speak and convey a message of hope, a solution to the madness, a future of balance are endless. As a result I attempt to reach every eager ear willing to listen. From Charlotte to Tampa to Toronto to Philadelphia to Seattle to Baton Rouge to Vancouver, I travel in an endless march with a sense of urgency for our time to prevent the tipping point is limited.

We have begun to enter the dark ages, a period of regression from an era of excess and greed. As a small boy I watched my father commute each morning to Wall Street and learned the arcane language of the stock market. As a system once entirely devoted to raising capital for an expanding economy, it has recently digressed into a manipulated arena of speculation and gambling. Without emotion I witnessed the total collapse of the system that provided my father a career for over forty years. My father would not recognize Wall Street today, with the bodies of power brokers and market makers smoldering in the flames of a conflagration unimagined. Goldman Sachs, Lehman Brothers, Merrill Lynch and Bear Stearns were once the powerful barbarians at the gate, the piranhas that would strip a company of its flesh, discards its bones in the gutter. I had to admit some sense of retribution when the piranhas turned on the mighty Wall Street elite and erased billions of dollars of equity in a matter of weeks. The poor stockholders who reaped the rewards of years of greed and plunder cried for the government to protect them from their own imprudence. I do not weep over their loss, for they were a parasite feeding on the sweat equity of Main Street.

Where we not warned there will be blood? All of these troubles are attributable to the failure to exercise reasonable prudence. Why should I be responsible for paying to guarantee the sins of others? It’s ironic that the financial conservatives, who proclaim the loudest that a free market is essential to our way of life, are the first to beg for intervention from the government. I have no sympathy for the greed that motivated the couple to buy a house they could not afford. I have no sympathy for the banker that made the toxic loan in hopes of unloading it within 30 days. Even our sub-prime market became drunk with profits and greet. Staring into an abyss we may never see again the world we have become so fond of.

This small financial event is likely to be obscured by a global cataclysm of monumental proportions if we continue to fund our lifestyle on fossil fuels. Skeptics surround us chanting in hopes of convincing us to destroy more of our planet in search of the opium of commerce. They ignore the impending death of the fossil fuel economy with righteous indignation while the slogan “drill baby drill” is repeated as a bible quote. As climate change is advancing with mythological speed many sit idle in their comfortable live of luxury assuming that it was just some 10,000 researches have gotten it wrong. The threat of climate refugees will number in the millions if not billions. The global economy is in jeopardy of total collapse, just look at one somewhat minor weather event called Katrina. It turned the gulf coast into a third world country. A total break down of the tenuous and fragile concept of social order. We need to consider our options carefully and with a great sense of urgency. We have reached the capitulation of excess.

“One of the weaknesses of our age is our apparent inability to distinguish our need from our greed.”

Author Unknown

“If the world should blow itself up, the last audible voice would be that of an expert saying it can't be done.”

Peter Ustinov (1921 - 2004)